Improvements in industry processes are always favored, particularly those that increase safety and ease for all parties. Recent news from Washington D.C. sheds light on the power and potential of technological advancements under the online notarization bill for reducing risk and burdens in the title industry.

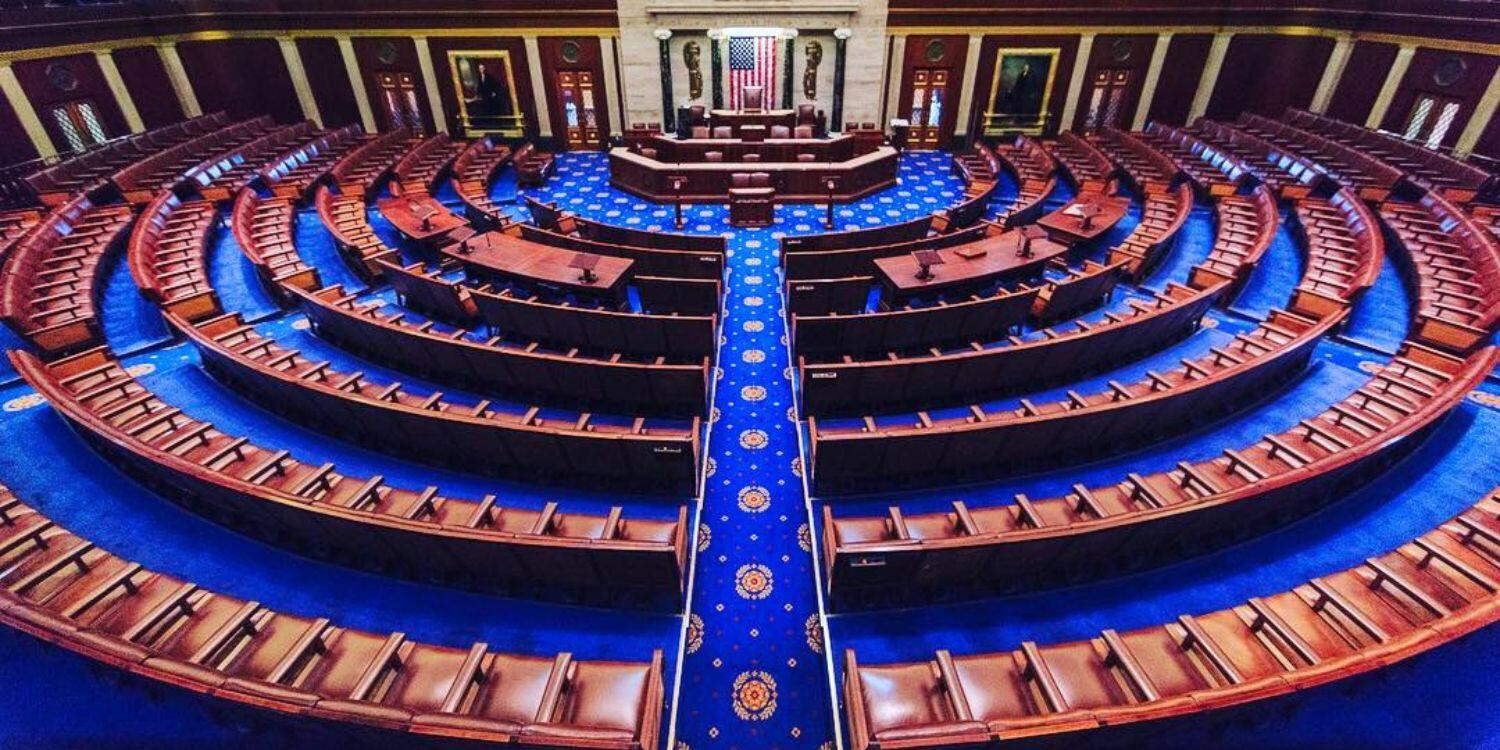

The pandemic highlighted a need for more streamlined, remote service options. We’re excited to report that the U.S. House of Representatives approved via a bipartisan voice vote on Monday, February 27, 2023, the Securing and Enabling Commerce Using Remote Electronic Notarization Act (SECURE Notarization Act) of 2023 (H.R.1059). Read on to find out more.

What is The SECURE Notarization Act?

Approximately 43 states and D.C. already have legislation for remote online notarizations (RONs) that allow notaries to perform legally approved duties online rather than in person. Yet, various problems exist beyond the lack of nationwide approval. Most states have independent laws around notary-related offline and online document handling and approval processes.

The SECURE Notarization Act is set to change everything by providing a framework for standardized RONs on a national level as part of interstate commerce. It would allow members of the military, others working overseas, senior citizens, caregivers, and people dealing with serious illness to move forward with notarization tasks that traditionally required the face-to-face presence of a notary public. These services are critical in the real estate industry when selling, purchasing, and mortgaging properties.

The basics of the legislation:

– All states and courts within the U.S. must recognize RONs no matter the physical location of the notaries within the country.

– Notaries could “remotely notarize electronic records and perform notarizations for remotely located individuals,” including people in other countries under special circumstances.

– All notaries and others who used the applicable services would have to follow specific technical standards related to communication technologies, including video chat and the “creation and retention” of audio and video recordings.

The CEO and President of Mortgage Bankers Association (MBA), CMB Bob Broeksmit, stated that he believes the creation of minimum federal standards with this legislation would allow notaries to perform “safe and effective” RONs in all states. The legislation makes closing processes “more convenient” and “protects against fraud.” He noted that RON standards of the Mortgage Industry Standards Maintenance Organization (MISMO) and the MBA-ALTA model state bill are met.

What Exceptions to the Legislation Exist?

The only major exception relates to pre-existing laws. If a state already has a RON law that provides the same or better standards, it would always represent the primary legal guidance, especially if better consumer protection and fraud-prevention standards are offered. At this time, additional exceptions are unknown.

What Happened to the Last Bill?

Although under a previously different majority during the 117th Congress, this is the second time the House approved the SECURE Notarization Act. During the 2021-2022 session, they passed previous H.R.3962 legislation by the same name. The Senate Bill (S. 1625) was also passed on to Committee and stalled earlier this year.

The reintroduction of the Legislation on February 17 by Rep. Kelly Armstrong, R-N.D., and Rep. Madeleine Dean, D-Pa. and rapid approval within a mere 10 days combined with strong support from sides that have become more partisan over the years is a good sign. Fast approval pressures the Senate to introduce a companion bill and re-address the matter faster.

Final Thoughts

We agree with experts that the failures of the 2021-2022 Senate to pass this eNotarization legislation are unlikely this time around for several reasons:

Consumers, notaries, and industry leaders demand electronic convenience, simplified standards, heightened safety and security, and reduced manual processes that aren’t economically or environmentally sustainable. People are weary of losing time and money to conflicting state standards. They’re also frightened of risks associated with face-to-face transactions. Lastly, for an increasingly stay-at-home market, these changes are critical for equal accessibility.